The Income-Driven Repayment (IDR) Account Adjustment Has Been Applied to Eligible Borrowers’ Accounts.

Big news for federal student loan borrowers—the Department of Education has officially completed the one-time Income-Driven Repayment (IDR) account adjustment. This adjustment was a major initiative aimed at helping federal loan borrowers track and receive payment credit to get closer to loan forgiveness through Public Service Loan Forgiveness (PSLF) or income-driven repayment (IDR) forgiveness. Here’s what you need to know about what has happened, what it means for your loans, and the next steps you should take.

What was the one-time IDR Account Adjustment?

The one-time IDR adjustment was introduced as a way to correct past administrative errors and oversights in the management of federal student loans. Many borrowers who were enrolled in IDR plans weren’t getting proper credit for payments made, especially during periods of deferment, forbearance, or when their loans were in the wrong repayment status.

This adjustment retroactively credits borrowers for qualifying payments—even if they’ve never enrolled in an IDR plan—bringing many closer to loan forgiveness under IDR and Public Service Loan Forgiveness (PSLF) programs.

EVERY student loan borrower with federally-held FFEL loans and Direct loans benefited from this adjustment (or should have, anyway).

Key impacts of the adjustment

Increased Payment Counts: Borrowers may see an increase in their qualifying payment counts toward IDR forgiveness (which occurs after 20 or 25 years of qualifying payments) and PSLF (for those who work in public service).

Immediate Forgiveness: Some borrowers may have reached the threshold for forgiveness and seen their remaining loan balances wiped out.

Consolidation Benefits: Those who consolidated loans before September 1, 2024, could maximize the credit received, even when payments weren’t properly tracked.

I can’t overstate how big of a deal this is! Borrowers get payment credit for months they paid late or less than the amount due, were NOT on an income-driven repayment plan, had the wrong type of loans (like commercially-held FFEL loans), and more.

What should borrowers do now?

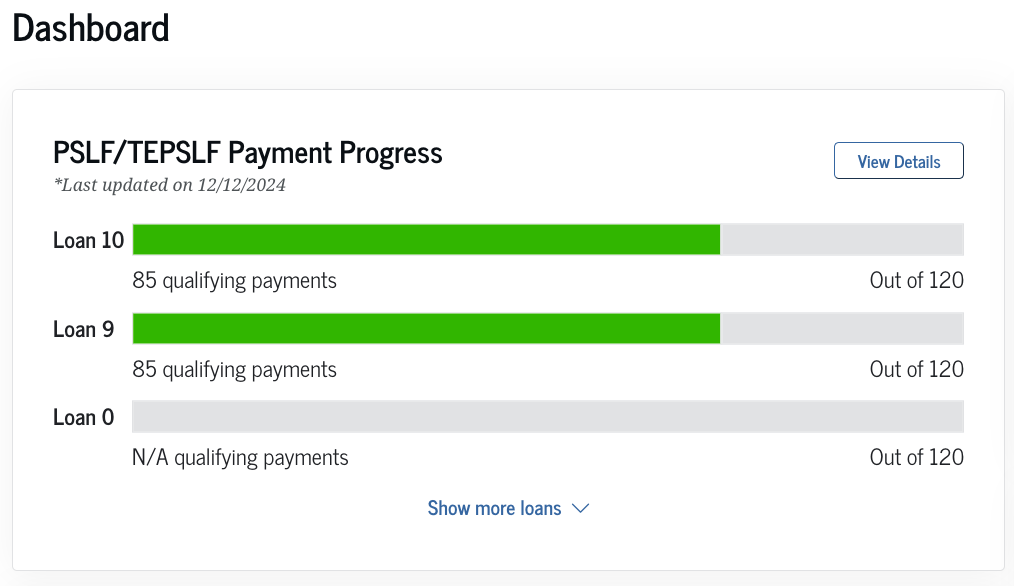

The most important thing is to log into studentaid.gov and review your updated payment count toward forgiveness. As long as you have federally-held FFEL or Direct loans, you’ll immediately see an IDR or PSLF payment tracker on your dashboard after logging in. I was pursuing PSLF a few years ago when I worked at UW-Madison, so here’s what my PSLF tracker looks like after the adjustment:

Then, I clicked the View Details button which led me here:

Next, I clicked Show Payment Summary for each loan:

Finally, I clicked the View button next to the qualifying payments, which showed all of my PSLF-qualifying payments.

I was pleasantly surprised!

I got more PSLF credit than I expected! Not only did I get credit for months I was enrolled in the 20-year Standard plan (which I expected), but I also got credit when I was in school half-time during the COVID forbearance! Usually, half-time enrollment puts loans into an in-school deferment, which does NOT count toward PSLF. I forgot to waive the in-school deferment proactively, so I worried I wouldn’t get PSLF credit for that time.

PRO TIP: Here’s another spot to check your IDR forgiveness count….

This will work if you’re pursuing PSLF and wondering what your IDR payment count is OR if you’re pursuing IDR forgiveness and the count on your dashboard looks wrong. You should check one more spot: the IDR application!

Log into studentaid.gov

Use either application on this page

Keep clicking through until you pass the contact information and reach your federal student loan breakdown.

It will display your Qualifying IDR Payments.

I also tried this with a client earlier this week after we realized her IDR payment counter on her dashboard looked low. Their count on this page was more accurate than her dashboard.

If both places show lower payment counts than you’re owed, here is what you can do

If you’re pursuing PSLF and believe you’re owed more credit:

Submit a new PSLF form through the PSLF Help Tool.

Submit a reconsideration request.

If the above steps haven’t worked, OR if you’re pursuing IDR forgiveness:

Submit an online complaint with a Federal Student Aid (FSA) ombudsman.

Submit a complaint with the Consumer Financial Protection Bureau (CFPB).

Contact your state representative’s office for assistance OR your state’s student loan ombudsperson (if you have one).